How can AI power your income?

Ready to transform artificial intelligence from a buzzword into your personal revenue generator

HubSpot’s groundbreaking guide "200+ AI-Powered Income Ideas" is your gateway to financial innovation in the digital age.

Inside you'll discover:

A curated collection of 200+ profitable opportunities spanning content creation, e-commerce, gaming, and emerging digital markets—each vetted for real-world potential

Step-by-step implementation guides designed for beginners, making AI accessible regardless of your technical background

Cutting-edge strategies aligned with current market trends, ensuring your ventures stay ahead of the curve

Download your guide today and unlock a future where artificial intelligence powers your success. Your next income stream is waiting.

ARTIFICIAL INTELLIGENCE

AI-optimized IaaS spend will more than double in 2026

IT teams are gearing up for a big jump in spending on cloud infrastructure tuned for AI (called “AI-optimized IaaS”).

Spending Surge

By 2026, enterprise spending in this area is expected to more than double, reaching around $37.5 billion. This year alone, forecasts put it at about $18.3 billion.

Where the Money Is Going

Most of the growth will come from inference workloads (running trained models) rather than training new ones — about 55 % of the 2026 spend.

To support that, firms will need hardware like GPUs, AI-specific chips (ASICs), fast networks, and storage systems built for parallel data flow.

Why It Matters

Traditional IaaS (CPU-based, general purpose) is becoming less suited to the demands of modern AI. Because of that, enterprises are moving toward purpose-built cloud stacks.

Major cloud players are already making big bets:

• A joint AI Infrastructure Partnership (with Microsoft, Nvidia, others) bought a large data center business to scale capacity.

• Oracle formed alliances with AMD and Nvidia to boost its AI infrastructure offerings.

CLOUD PROVIDERS

Global Cloud Market Nears $100B, Neoclouds Surge 200%

Cloud spending hit $99 billion in the second quarter of 2025, rising 25% from last year. Most of the momentum comes from companies running AI systems. Since early 2023, cloud revenue has grown by $36 billion, with IaaS and PaaS making up most of it.

Who Leads the Market

Amazon holds 30% of the sector, followed by Microsoft at 20% and Google at 13%. Smaller firms like CoreWeave, Oracle, Databricks, and Huawei are catching up fast. CoreWeave passed $1 billion in quarterly revenue only two years after starting from zero.

Total cloud revenue over 12 months is now $366 billion. The US leads growth at 25% in Q2. In Europe, the UK and Germany are biggest, with Ireland, Spain, and Italy growing the fastest. Outside Europe, Brazil, India, Australia, Indonesia, and Mexico are rising above the global average when measured locally.

Rise of Neocloud Providers

A new group of GPU-focused providers is emerging. These firms earned more than $5 billion in Q2, up 205% from last year. They focus on GPU access, AI hosting, and dense data centers. CoreWeave, Crusoe, Lambda, Nebius, and OpenAI lead the pack.

This segment is expected to bring in $23 billion next year and could reach $180 billion by 2030, growing about 69% each year. A report from JLL says demand for GPU capacity is outpacing what big cloud companies can currently supply.

AI workloads need over 100 kW per rack and stronger cooling, pushing data centers to upgrade their setups.

Competitive Shifts

Neoclouds are scaling by reusing old crypto infrastructure or starting fresh with AI in mind. They often place their data centers in cheaper areas with more power available. Larger cloud providers are also expanding GPU and AI services, blurring the line between both groups.

New players like Applied Digital, Northern Data Group, Together AI, and WhiteFiber are entering, while OpenAI stands out due to its consumer services and large projects like Stargate.

Analysts say neoclouds will keep gaining ground in high-growth areas tied to AI. Factors like energy access, land costs, business rules, skilled labor, and customer demand will shape where providers build next.

Cloud growth is now driven by whoever can feed AI’s growing appetite fastest.

📺️ INTERVIEWS

Is the AI bubble about to pop?

Ars Technica hosted a live conversation with Ed Zitron, host of the Better Offline podcast and one of tech’s most vocal AI critics, to discuss whether the generative AI industry is experiencing a bubble and when it might burst.

Zitron covered OpenAI’s financial issues, lofty infrastructure promises, and why the AI hype machine keeps rolling despite some arguably shaky economics underneath.

CLOUD INFRAFSTRUCTURE

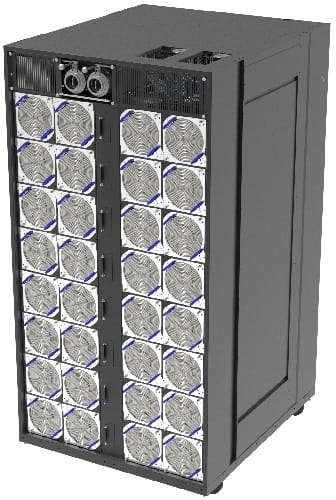

Next Generation HXU: Doubling Cooling Power for the AI Era

Cooling tech is being pushed hard by AI systems, and older air setups can’t keep pace. A newer Heat Exchanger Unit (HXU) has been built to fix that. It delivers twice the cooling power as the earlier version without taking more floor space.

Why It Matters

AI hardware draws massive power, often beyond 200 kW per rack. Many datacenters still rely on air systems not designed for that load. Fully switching to liquid cooling is expensive and slow, so operators need something that fits into what they already have.

What the New HXU Delivers

The new unit supports more than 240 kW per rack. It handles higher heat loads while staying in the same physical footprint. That means operators don’t need major rebuilds to support newer AI chips.

To keep systems running, the unit has backup pumps, fans, and power feeds. It is aimed at uptime above 99.9%, so critical workloads do not go offline.

Design And Operations

It keeps the same size as the older model for easy fit. It uses modular parts for pumps and filters and includes leak detection and quick-connect parts to make setup and service easier.

The unit also meets major security standards and supports firmware checks. Built-in telemetry helps detect issues early.

Looking Forward

By doubling cooling strength and improving reliability, this unit helps datacenters handle the rapid rise of AI systems without starting from scratch.

AI growth needs stronger cooling, and this design steps in to meet that load.

DATA PROTECTION

What to look for in a data protection platform for hybrid clouds

Hybrid cloud has become the dominant deployment model (80% of enterprises), with 60% of corporate data now in the cloud. That data is highly distributed—across SaaS, IaaS, IoT, edge, and on-prem systems—making traditional, siloed security and backup models insufficient. Data protection must go beyond encryption and DLP to ensure recoverability, resilience, compliance, and accessibility for AI/analytics.

Key Drivers

Ransomware – Directly targets and encrypts data; exfiltration adds extortion risk.

Outages & climate events – Cloud-based DR and redundancy are essential.

Privacy regulations – Require governance, control, auditability, and user rights management.

Misconfigurations – A top breach vector; CSPM and consistent policy enforcement needed.

AI & analytics – Depend on trustworthy, accessible, high-fidelity data.

Exploding data volume – More data, higher value, greater management overhead.

Core Capabilities of Modern Hybrid Data Protection

Data discovery & classification (sensitivity, regulatory scope)

Vulnerability assessment (misconfigurations, infrastructure gaps)

Protection & security controls

Encryption (in transit/at rest)

Masking, CASB, DLP

Immutability & air gapping

Monitoring & analytics (telemetry, alerting, visibility)

Access control (policy, least privilege, anomaly blocking)

Audit & compliance (forensics, reporting, separation of duties)

Scalability & performance (no operational friction)

Automation (orchestration, DR workflows, recovery acceleration)

CLOUD STORAGE

From dark data to bright insights: The dawn of smart storage

Unstructured data has become a roadblock for companies trying to use AI. Most of it sits untouched because it’s not labeled or searchable. Google Cloud is trying to change that by turning storage into something smarter, not just a place to park files.

Why unstructured data holds businesses back

Over half of company data is unstructured and rarely used. Old tools can store it, but can’t explain what’s in it. People end up building manual pipelines just to make sense of images, videos, and documents. That slows everything and leaves most data unused.

Smart storage as the new default

Google Cloud is adding two features to flip the script:

Auto annotate creates metadata using AI when new files land in Cloud Storage.

Object contexts let teams attach custom tags and manage that metadata directly in storage.

Together, they remove the need for custom pipelines and make the data searchable and ready for analysis.

How it works

Auto annotate uses Google’s AI models to add labels, detect objects, and flag sensitive content. It runs on new and existing images once enabled.

Object contexts store those annotations and any custom tags. They work with APIs, IAM controls, BigQuery, and even convert tags from Amazon S3 automatically.

What this enables

Data discovery becomes faster. Teams can search images by content instead of guessing where they live.

AI training gets easier. You can pull balanced datasets or filter by attributes like color or object type without sorting by hand.

Governance improves. Sensitive content can be flagged and acted on with automated rules.

Real-world use

Vivint cut AI development time from six months to one by using annotations to find specific images.

BigID uses object contexts to label and flag high-risk content for customers.

What’s next

Object contexts are ready now. Auto annotate is in early access. Once turned on, it can label entire image libraries and make those labels available for search and workflows.

Smart storage is becoming a core part of how companies prepare data for AI instead of letting it sit unused.

If you like Clouds Weekly, you may like

Want your brand in this Newsletter? Click here